EMA - Exponential Moving average - gives priority to most recent data, thus reacts to price changes quicker than Simple Moving Average. WMA - Weighted Moving Average - puts emphasis on most recent data an less - on older data. Most common settings for Moving Averages in Forex. EMA and SMA SMA 50 SMA 34 SMA 20 EMA and 20 SMA 10 EMA May 24, · Using EMA Crossovers as a Buy/Sell Indicator When considering strategy, a trader might use crossovers of the 50 EMA by the 10 or 20 EMA as trading signals. Another strategy that forex Mar 05, · The EMA “Red” line with a longer period setting follows the upward trend, lagging below and forming an angled support line until the trend begins to reverse its direction. The “Blue” EMA line, with period setting 13, reacts more quickly and is embedded inside the candlesticks. The benefit of the EMA indicator is its visual blogger.com: Forextraders

How to Use Exponential Moving Averages in Forex Trading

The exponential moving average EMA smooths the effects of price changes by giving the highest significance to most recent prices. Exponential moving average EMA is a technical indicator which differs from other moving averages in that its calculations give greater weighting to the most recent price data. It therefore gives importance to the most recent behaviour of traders. This means the exponential moving average indicator can react much faster to changes in the price of an asset.

Using EMA as part of your trading strategy is not limited to one specific instrument, and you can set up an EMA line for a variety of trading instruments.

The most common periods used by traders in setting an EMA time frame areema currency line forex factory, and day periods for the long-term line. The typical short-term time frames used by traders are the day and day EMAs. You should remember to modify the EMA set-up when you trade new instruments because there is no "one size fits all" structure.

EMA reduces the effect of the noise by cutting the time lag of the data. This is because EMA may exclude past prices which no longer have an impact. By assigning a greater weight to newer prices, the EMA line sits closer to the price action than does the simple moving average SMA.

Let's look at the graph, with blue lines representing the EMA and red lines showing the SMA. Note that there are three points signalling changes in direction. On the left and the right we see a downward trend, while in the middle of the graph the price movement is upward. It is clear that the EMA signals directional changes earlier than the SMA in all three cases, ema currency line forex factory.

This is because the EMA line adapts faster to price changes than the SMA line, and therefore it signals earlier. EMA is often the preferred moving average indicator for day traders who tend to execute their trades swiftly. You can use the EMA as a standalone indicator for your trading strategy, but make sure you have defined a system with which to confirm the signals identified. You can also set up two EMAs with different time frames, or combine the indicators with other technical analysis indicators.

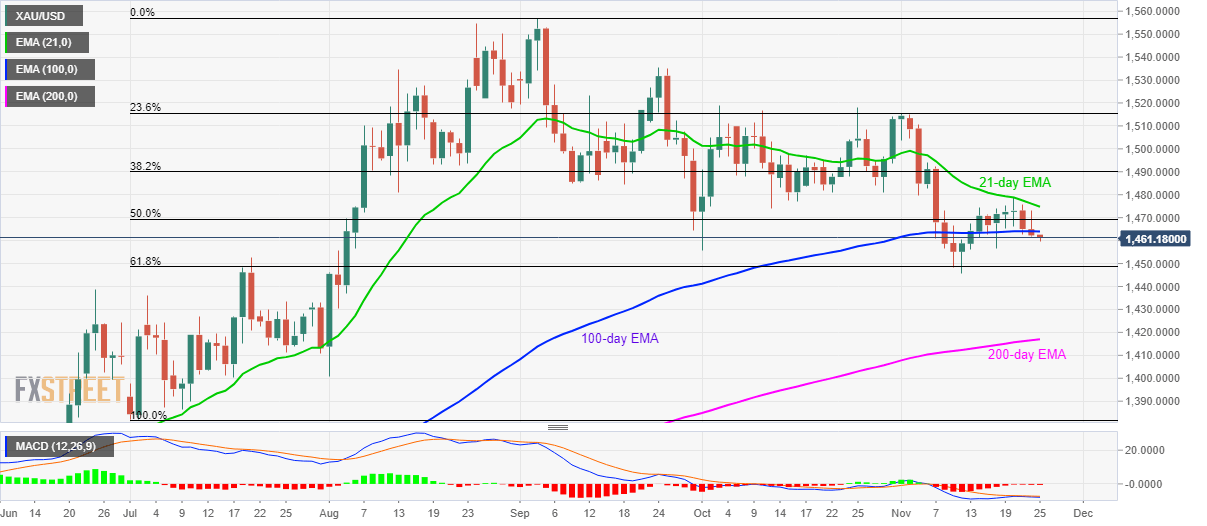

You can use the EMA in your trading strategies in the same way you use other moving averages. Accordingly, you should identify ema currency line forex factory trend direction or look for a buy or sell signal using two exponential moving averages with different time frames. A buy - or golden cross- signal occurs when a shorter-term EMA moves above a longer-term EMA, known as a golden cross signal. A sell signal known as a death cross can be identified when a short-term EMA line moves below a longer- term EMA line.

Since EMA is one of the moving average indicators, it can also provide the opportunity to determine potential support and resistance levels. Before defining and plotting an ema currency line forex factory moving average for the selected instrument, you should know how to read EMA. The application of EMA when executing trades follows the general rules for moving average indicators which can be summarised as:.

You can develop an exponential moving average trading strategy by combining multiple EMAs with different time frames. Of course this doesn't mean that you should employ every possible type of indicator, thinking this will increase accuracy. It would instead mean a very complex trading strategy.

You should test different combinations of indicators and see which works best for you. Avoid the inclusion of multiple indicators ema currency line forex factory the same signals and you will avoid the potential redundancy. Look at the graph below to see how a day EMA might help you to identify potential increases in price. At the indicated points, you can see that during an upward trend, when the price touches the line, EMA signals a support level and the price moves up again.

This signal indicates potential ema currency line forex factory points. Consequently, sell signals using the day EMA will be identified when the price touches the line from below, indicating that EMA serves as resistance. EMA alone cannot determine optimal entry and exit points as it is a lagging indicator; instead, it provides postponed points. Nevertheless, it is a valuable indicator when you want to determine the direction of the trend. FURTHER READING: How to read trading charts. FURTHER READING: How to read and use moving average indicators.

Bonus withdrawal can be a subject to additional commission. We can recommend Capital. comone of the highest rated trading platforms in the world. Learn to trade Trading guides. How to read and use the exponential moving average EMA indicator By Zoran Temelkov. The exponential moving average EMA smooths the effects of price changes by giving the highest significance to most recent prices Exponential moving average EMA is a technical indicator which differs from other moving averages in that its calculations give greater weighting to the most recent price data.

Exponential moving average example EMA reduces the effect of the noise by cutting the time lag of the data. How to use exponential moving average? The application of EMA when executing trades follows the general rules for moving average indicators which can be summarised as: EMA with a longer time frame helps you identify the general trend of a security or the market. If the price crosses a long-term EMA, such as the day line, this indicates a possible reversal.

Plotting one EMA ema currency line forex factory a short time frame and another with longer time frame helps to identify crossovers. A golden cross signals a potential buying opportunity. A death cross signals a potential selling opportunity, ema currency line forex factory. Identify support levels — when the price intersects with EMA line from above, the line serves as a support. Identify resistance levels — if the price touches the line from below, ema currency line forex factory, it will show that EMA serves as potential resistance level.

Advantages of exponential moving average Eliminates the drawbacks of placing equal weights on all price changes Includes latest prices change much more quickly than simple moving average indicators EMA can be preferable to simple moving average in volatile markets because it adapts swiftly to price changes Disadvantages of exponential moving average EMA is susceptible to whipsaw or incorrect signals because of its ability to quickly adapt to price changes EMA alone cannot determine optimal entry and exit points as it is a lagging indicator; instead, it provides postponed points.

FURTHER READING: How to read trading charts FURTHER READING: How to read and use moving average indicators The material provided on this website is for information purposes only and should not be regarded as investment research or investment advice. Any opinion that may be provided on this page is a subjective point of view of the author and does not constitute a recommendation by Currency Com Bel LLC or its partners.

We do not make any endorsements or warranty on the accuracy or completeness of the information that is provided on this page. By relying on the information on this page, you acknowledge that you ema currency line forex factory acting knowingly and independently and that you accept all the risks involved. Share ema currency line forex factory Copied. com Exchange. By using the Currency. com website, you agree to the use of cookies.

Welcome to Currency. I'm not from Spain proceed to Capital.

How to use Forexfactory to your advantage

, time: 6:45How to read and use the exponential moving average (EMA) indicator | blogger.com

Requirements For The 34 EMA Trend Line Strategy. You will need to plot a 34 exponential moving average on your chart. That is simple to do and if you are having any issue, consult the user manual of your charting platform. Ensure you have a rule based method of drawing a trend line. You must be consistent with all aspects of your trading EMA - Exponential Moving average - gives priority to most recent data, thus reacts to price changes quicker than Simple Moving Average. WMA - Weighted Moving Average - puts emphasis on most recent data an less - on older data. Most common settings for Moving Averages in Forex. EMA and SMA SMA 50 SMA 34 SMA 20 EMA and 20 SMA 10 EMA Currency Pairs: Any. Forex Indicators: 34 EMA (or you can use other EMA’s like 14, or 21 etc its up to you but the concept is the same regardless) What you need is a 34 EMA, which is primarily used only for determining trend direction of the forex market and an ability to draw a good trendlines

No comments:

Post a Comment