/9/28 · The flag pattern identifies the possible continuation of a preceding trend from a previous point against the same direction. Generally, Flags are areas of tight consolidation in price action. It shows that a counter-trend move after a sharp price fluctuation. The /1/27 · Measure the distance of the pole from the start of the pole—the start of the sharp move—to the tip of the flag. If it is $1 long (in the stock market) and the breakout was to the upside, add $1 to the bottom of the flag. If the breakout was to the downside, subtract $1 from the top of the blogger.comted Reading Time: 4 mins Profile Profile Settings Account and Billing Referred friends Coins My Support Tickets Help Center Dark color theme Sign Out Sign in Upgrade Upgrade now day Free Trial Start free trial Upgrade plan Pay nothing extra Upgrade early Get 6 months free Use last chance Get a month for $1

ACHN Flaging for NASDAQ:ACHN by kilimats — TradingView

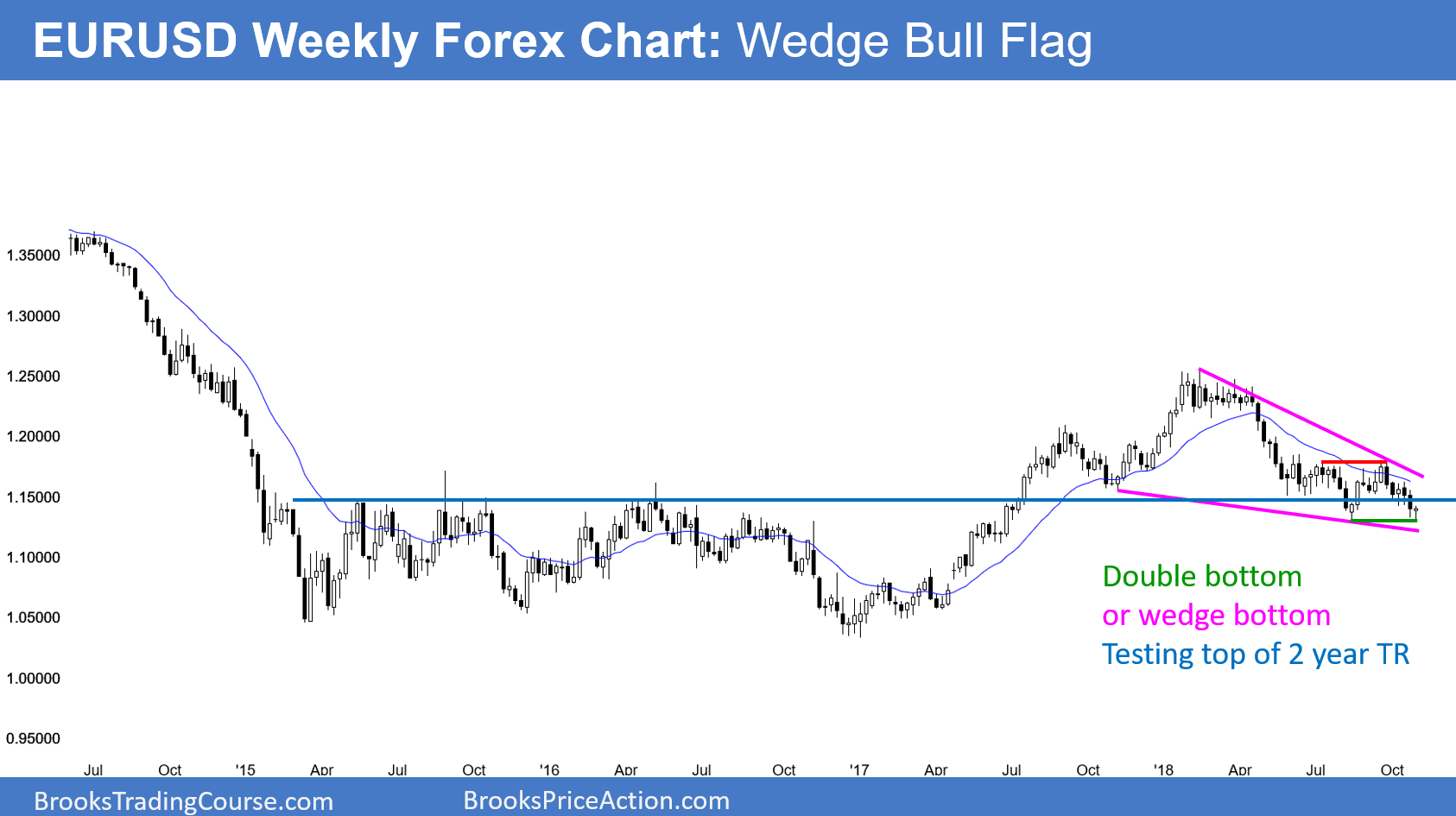

There are many price action patterns that traders use to catch moves, but none of them catch my eye quite like bullish and bearish flags. The characteristics are easy to identify, making it a great option for beginners. The first thing to know about this chart pattern is that it represents consolidation.

This means that it occurs after a large movement in price. The illustration above shows a bullish flag pattern, flaging wedge forex.

However, its bearish alternative has the same components. The difference is that a bearish flag is the exact inverse of the illustration above. This is the initial move in price. It can be represented by either an uptrend or a downtrend, flaging wedge forex. The angle of this move is irrelevant in terms of the validity of the flag pattern. The distance of the move should be measured by calculating the previous swing high or low to the current swing high or low.

As an example, we would measure from the bottom of the red line to the top of the red line in the illustration above. The flag formation is the key to this pattern. This is the point at which, after a strong move in price, the market consolidates for a period of time, flaging wedge forex. The length of time is irrelevant, however do note that longer consolidation periods tend to lead to more aggressive breakouts.

At this point the market has finished consolidating and is now trending in the original direction. Using the distance we calculated flaging wedge forex for the flag pole, we now have a measured objective for a possible target. Notice in this example how the continuation is the exact same length as the flag pole.

The distance for the flag pole is measured from the swing low to the swing high of the flag pattern. Similarly, we measure from the swing low of the flag pattern to the swing high of the continuation, flaging wedge forex. In the example below, both represented an equal distance of pips. A bit different from the GBPUSD flag above, this bullish flag on AUDCHF flaging wedge forex almost an equal distance to that of the flag pole itself.

Furthermore, the flag pole was approximately pips while the continuation only resulted in a pip rally. So while the two were very close in terms of distance traveled, there was a slight difference. Last but not least we have a bearish flag pattern on EURCAD. Just like the bullish flags above, this bearish flag has a flag pole and continuation that are both equal distances of pips. I hope this lesson has provided you with a blueprint of what to look for when identifying bullish and bearish flag patterns.

For now, just focus on being able to identify these patterns — they occur all the time and can be a powerful asset in your trading toolbox. Bullish and Bearish Flag Patterns. So what exactly is a bullish or bearish flag pattern? Components of a Flag Pattern The flag pole The flag The continuation The flaging wedge forex above shows a flaging wedge forex flag pattern.

Let me explain each component in greater detail. The Flag Pole This is the initial move in price. The Flag The flag formation is the key to this pattern. The Continuation At this point the market has finished consolidating and is now trending in the original direction.

GBPUSD Bullish Flag Notice in this example how the continuation is the exact same length as the flag pole. AUDCHF Bullish Flag A bit different from the GBPUSD flag above, this bullish flag on Flaging wedge forex extended almost an equal distance to that of the flag pole itself, flaging wedge forex.

EURCAD Flaging wedge forex Flag Last but not least we have a bearish flag pattern on EURCAD. In Closing I hope this lesson has provided you with a blueprint of what to look for when identifying bullish and bearish flag patterns.

Triangle Chart Pattern Technical Analysis [100% profit]

, time: 6:07Bullish and Bearish Flag Patterns | Daily Price Action

Profile Profile Settings Account and Billing Referred friends Coins My Support Tickets Help Center Dark color theme Sign Out Sign in Upgrade Upgrade now day Free Trial Start free trial Upgrade plan Pay nothing extra Upgrade early Get 6 months free Use last chance Get a month for $1 A flag can be used as an entry pattern for the continuation of an established trend. The formation usually occurs after a strong trending move that can contain gaps (this move is known as the mast or pole of the flag) where the flag represents a relatively short period of indecision. The pattern usually forms at the midpoint of a full swing and /9/28 · The flag pattern identifies the possible continuation of a preceding trend from a previous point against the same direction. Generally, Flags are areas of tight consolidation in price action. It shows that a counter-trend move after a sharp price fluctuation. The

No comments:

Post a Comment