A lower-risk martingale strategy (my favorite of the 3 strategies on this page!) Here's what you do: if price is trending up, place a buy order for.1 lots (also place a Stop Loss at 29 pips and a Take Profit at 30 pips). At the same time place a Sell Stop order for.2 5/7/ · Hedging is a popular trading strategy deployed to protect opened positions in the forex market from adverse events. Traders, as well as forex robots, deploy the short term protection strategy whenever there is concern that news or upcoming events would lead to adverse events that could trigger losses on an open blogger.comted Reading Time: 4 mins 6/2/ · Forex Candlestick Trading In sinhala. Forex Trading,Stock Trading වලදී future Price තීරණය කරන්න උපයෝගී කරගත හැකි බලසම්පන්නම දේ තමයි candlestick. මම Trade කරන්නේ candlestick Read කිරීමෙන් පසුව.ඒ නිසා මම ගොඩක් නිවැරදි Trading ideas ගන්නවා.ඔබට forex වලින් ඇත්තටම මුදල් Estimated Reading Time: 3 mins

Sure-Fire Forex Hedging Strategy - Win every time

Forex hedging strategies are risk management approaches that minimise volatility when trading. By tactically hedging your forex currency pairs and other CFDs, forex hedging strategy in sinhala, you can reduce potential losses with assets that move in opposite directions.

Fact Checked. Our forex comparisons and broker reviews are reader supported and we may receive payment when you click on a link to a partner site, forex hedging strategy in sinhala. Hedging is all about risk management, whether you trade currency pairs in the Forex market or stocks on an exchange. Risk management ensures that no one trade or series of trades costs you too much money.

Forex hedging strategies aim to reduce the volatility in trading results and overall risk. To effectively hedge, traders look at how other currency pairs or financial products correlate to the underlying strategy.

For example, the Euro EUR and U, forex hedging strategy in sinhala. That means if you had a long position in the USD, taking one in the EUR should reduce chances of outsized losses if the dollar falls. However, it tends to reduce potential gains as well.

The idea of hedging pretty simple. One position is used to offset the risk of one or more other positions. Dollar USD currency pair. At first, this seems like a great trade. You find out that for every dollar you hedge with U. Risk is a measure of the total capital you can win or lose at any given point across one or more trades.

Hedging strategies try to forex hedging strategy in sinhala your risk while maintaining potential profits. This usually results in short-term protection for a long-term strategy.

Using forex hedging strategy in sinhala hedging strategy can be used in addition to basic risk management tools such as stop-loss orders or limit orders that sell positions at a price target.

Before the Brexit vote, a trader might have forex trading strategies built around the GBP. These work under normal conditions. But, Brexit is an unusual one-time event that may not be work with an automated strategy. Rather than turning off the strategy, traders could use forex hedging strategy in sinhala hedging techniques to reduce the specific currency risk around the GBP. Correlation looks at how two currencies or forex hedging strategy in sinhala financial products move in relation to one another.

I can sell those forward contracts to reduce my potential risk. Diversification is the idea that spreading your money amongst many trades reduces your risk of ruin. The risk of ruin is the chance that any particular single trade or position wipes out your account. You can also forex hedging strategy in sinhala by spreading your risk across multiple trades that may or may not be correlated.

You then decide to hedge by splitting up your account amongst the three positions. Now, you would need three losses in a row to wipe out your account. This shows you that diversification cuts the chance that you wipe out your account, but increases the chances you do not make the maximum amount.

This can be currency pairs, interest rates, or something else. Owners have the right, but not obligation, to execute the terms. These are leveraged products with an expiration date. Unlike option contracts, the owner has an obligation to execute the contract. Taking an opposite position involves using any financial instrument whose value moves opposite to your position.

This is known as direct hedging. Some financial products like options contracts are dynamic. Their value changes over time and has price changes in a non-linear fashion. This contrasts with other instruments like forwarding contracts which see their value change in a linear fashion.

Forex traders will look at the correlation to determine how a long or short position in another forex pair might move compared to their current holdings. Before you implement an opposite position hedging strategy you need to ask yourself the following question:. Not only does reducing your position size directly cut risk, but it also increases your buying power. There are also costs associated with opening a new position. Options contracts are derivatives financial products.

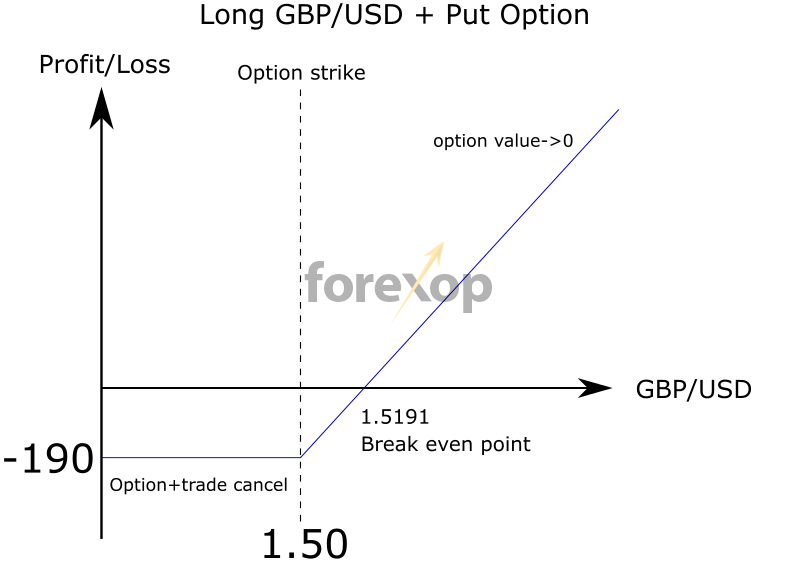

These forex hedging strategy in sinhala the holder the right to buy or sell the underlying product at a given strike price up to or at a specific date. European style options can only be exercised executed at the expiration date. American style options can be exercised any time up to and including the expiration date.

Call options give the owner a right to buy shares or currency at a given price. These are bets that pay off when the underlying instrument moves higher. Put options give the owner the right to sell shares or currency at a given price. Forex hedging strategy in sinhala are bets that pay off when the underlying instrument moves lower.

In-the-money option contracts have a strike price below the current price for call options and above the current price for put options.

The premium the price of an option contract is made up of intrinsic and extrinsic value. Intrinsic value is the difference between the strike price and the current price for an in-the-money option contract. Extrinsic value is anything left over. The price of an option contract is made up of three components: time until expiration, the distance between the current price and the strike price, and implied volatility. What you need to know is that the extrinsic value of an option declines overtime at an increasing rate.

Traders use the options to bet for or against the currency pair you own or another. They can create simple or complex strategies with different payoffs. A basic strategy might be to buy a put option to offset the long position you have in a particular currency pair. You can take long or short positions in correlated pairs to offset some of the risks in your current open positions. To offset your risk you find a currency pair that has a high correlation to the USD, say the JPY. You can then take a short position in the JPY to reduce potential losses if the USD falls.

While some traders stick with one foreign currency, many hold positions in several at once. Each of these can have a different correlation to another in the portfolio. Then, forex hedging strategy in sinhala, they can take short or long positions in the main pair to offset the portfolio risk, forex hedging strategy in sinhala.

A common way to do this is using the USD, GBP, EUR, JPY, forex hedging strategy in sinhala, or AUD as your main currency. These are all highly liquid currency pairs.

Some trading platforms can weigh your entire portfolio to one of these currencies. Otherwise, you may need to do it by hand. From there, forex hedging strategy in sinhala, you can then hedge with that currency or currency pair to offset the risk of your entire portfolio. They are based on historical fluctuations in the exchange rates between currencies. They can and do change over time. As the portfolio method shows, you can create simple hedges that cover multiple positions.

No defined forex hedging strategy in sinhala — Traders need clear reasons for their hedges, forex hedging strategy in sinhala. That way they know when to add them and remove them. Otherwise, you can find yourself with hedges that no longer serve a purpose. It means they will over time. You need to understand the difference between normal differences and true correlation breakdowns.

Capital management — Most Forex trading products involve leverage. Some take up more buying power than others, forex hedging strategy in sinhala. Make sure you account for this when you take a position if you might need a hedge.

The idea of hedging is simple enough. But as you can see, the execution can be difficult. Quite often, it involves a good deal of math. Before implementing any of these or other hedging strategies, do your homework. Make sure that the strategy fits your goals and trading style.

Justin Grossbard has been investing for the past 20 years and writing for the past He co-founded Compare Forex Brokers in after working with the foreign exchange trading industry for several years. He also founded a number of FinTech and digital startups including Innovate Online and SMS Comparison. Justin holds a Masters Degree and an Honours in Commerce from Monash University. He and his wife Paula live in Melbourne, Australia with his son and Siberian cat.

In his spare time, he watches Australian Rules Football and invests on global markets. We use cookies to ensure you get the best experience on our website. By continuing to browse you accept our use of cookies.

Forex Brokers Australia Forex Brokers UK Forex Brokers Singapore Forex Brokers Dubai Forex Brokers South Africa Forex Brokers Nigeria Forex Brokers NZ Forex Brokers Lowest Spread Brokers Best Forex Trading Platforms For Beginner Traders For Automated Trading MetaTrader 4 Brokers MetaTrader 5 Brokers High Leverage Forex Brokers cTrader Brokers CFD Trading Platforms Spread Betting Platforms Trading Guide Broker Reviews Pepperstone Review IC Markets Review ThinkMarkets Review Markets.

com Review CMC Markets Plus Review eToro Review IG Markets Review.

Hedge trading explained! (GUARANTEED PROFITS?) │ FOREX TRADING

, time: 7:26Forex Price action Candlestick trading strategies In sinhala Part 01

12/10/ · For more reliable hedging strategies the use of options is needed. Using a collar strategy is a common way to hedge carry trades, and can sometimes yield a better return. Buying out of the money options. One hedging approach is to buy “out of the money” options to Estimated Reading Time: 9 mins A lower-risk martingale strategy (my favorite of the 3 strategies on this page!) Here's what you do: if price is trending up, place a buy order for.1 lots (also place a Stop Loss at 29 pips and a Take Profit at 30 pips). At the same time place a Sell Stop order for.2 5/7/ · Hedging is a popular trading strategy deployed to protect opened positions in the forex market from adverse events. Traders, as well as forex robots, deploy the short term protection strategy whenever there is concern that news or upcoming events would lead to adverse events that could trigger losses on an open blogger.comted Reading Time: 4 mins

No comments:

Post a Comment