9/28/ · Let’s continue this Forex trading basics tutorial with the major currencies that are traded on the Forex market. Those include the US dollar (USD), euro (EUR), British pound (GBP), Swiss franc (CHF), Japanese yen (JPY), Australian dollar (AUD), New Estimated Reading Time: 8 mins 10/30/ · Forex options trading allows currency traders to realize gains or hedge positions of trading without having to purchase the underlying currency pair. more What Is Forex (FX) and How Does It This tutorial covers the fundamentals of forex trading. Audience. This tutorial is prepared for beginners to gain some knowledge before they begin their journey with trading. Professional who are already into forex trading can also draw benefit from this tutorial. Prerequisites. We assume that you know the essential terms related to forex trading and the basic standards of currency trade

How To Use FX Options In Forex Trading

Foreign exchange options are a relative unknown in the retail currency world. Although some brokers offer this alternative to spot trading, most don't. Unfortunately, this means investors are missing out. FX options can be a great way to diversify and even hedge an investor's spot position. Or, they can also be used to speculate on long- or short-term market views rather than trading in the currency spot market.

So, how is this done? Structuring trades in currency options is actually very similar to doing so in equity options. Putting aside complicated models and math, let's take a look at some basic FX option setups that are used by both novice and experienced traders. Basic options strategies always start with plain vanilla options. This strategy is the easiest and simplest trade, with the trader buying an outright call or put option in order to express a directional view of the exchange rate.

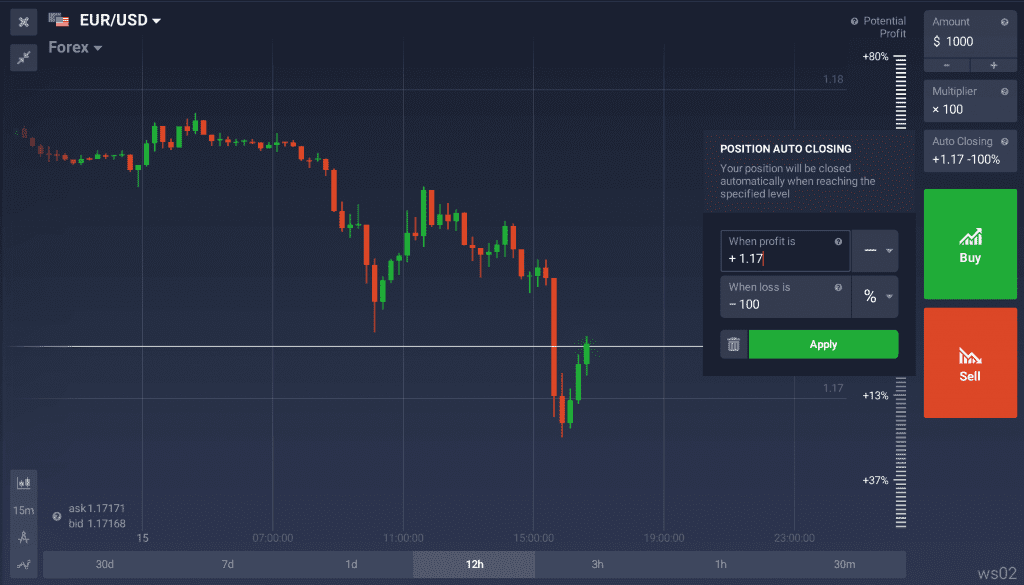

Placing an outright or naked option position is one of the easiest strategies when it comes to FX options. Taking a look at the above chart, we can see resistance formed just below the key 1. We confirm this by the technical double top formation. This is a great time for a put option, forex options trading tutorial.

An FX trader looking to short the Australian dollar against the U. dollar simply buys a plain vanilla put option like the one below:. ISE Options Ticker Symbol: AUM Spot Rate: 1. Profit potential for this trade is infinite.

But in this case, the trade should be set to exit at 0. Aside from trading a plain vanilla option, an FX trader can also create a spread trade. Preferred by traders, spread trades are a bit more complicated but they do become easier with practice. The first of these spread trades is the debit spreadalso known as the bull call or bear put.

Here, the trader is confident of the exchange rate's direction, but wants to play it a bit safer with a little less risk. In the chart below, we see an This is a perfect opportunity to place a bull call spread because forex options trading tutorial price level will likely find some support and climb. Implementing a bull call forex options trading tutorial spread would look something like this:. ISE Options Ticker Symbol: YUK Spot Rate: Gross Profit Potential: The approach is similar for a credit spread.

But instead of paying out the premium, the currency option trader is looking to profit from the premium through the spread while maintaining a trade direction. This strategy is sometimes referred to as a bull put or bear call spread. With support at dollar against the Japanese yen, a trader can implement a bull put strategy in order to capture any upside potential in the currency pair.

So, the trade would be broken down like this:. Potential Loss: As anyone can see, it's a great strategy to implement when a trader is bullish in a bear market. Not only is the trader gaining from the option premiumbut they are also avoiding the use of any real cash to implement it.

Both sets of strategies are great for directional plays. So, what happens if the trader is neutral against the currency, but expects a short-term change in volatility? Similar to comparable equity options plays, currency traders will construct an option straddle strategy. These are great trades for the FX portfolio in order to capture a potential breakout move or lulled pause in the exchange rate.

The straddle is a bit simpler to set up compared to credit or debit spread trades. In a straddle, the trader knows that a breakout is imminent, but the direction is unclear, forex options trading tutorial. In this case, it's best to buy both a call and a put in order to capture the breakout. The figure below exhibits a great straddle opportunity. Will the spot rate continue lower? Or is this forex options trading tutorial coming before a move higher?

Since we don't know, the best bet would be to apply a straddle similar to the one below:, forex options trading tutorial. It is very important that the strike price and expiration are the same. If they are different, forex options trading tutorial, this could increase the cost of the trade and decrease the likelihood of a profitable setup.

Net Debit: 95 pips also the maximum loss. The potential profit is infinite — similar to the vanilla forex options trading tutorial. The difference is that one of the options will expire worthless, while the other can be traded for a profit. In our example, the put option expires worthless pipswhile our call option increases in value as the spot rate rises to just under Foreign exchange options are a great instrument to trade and invest in.

Not only can an investor use a simple vanilla call or put for hedging, they can also refer to speculative spread trades when capturing market direction. However you use them, currency options are another versatile tool for forex traders.

Your Money. Personal Finance. Your Practice. Popular Courses. Table of Contents Expand. Basic Use of a Currency Option. The Debit Spread Trade.

The Credit Spread Trade. Option Straddle. The Bottom Line. Compare Accounts. Advertiser Disclosure ×, forex options trading tutorial. The offers that appear in this table are from partnerships from which Investopedia receives compensation, forex options trading tutorial. Forex options trading tutorial compensation may impact how and where listings appear. Investopedia does not include all offers available in the marketplace.

Related Articles. Partner Links. Related Terms Forex options trading tutorial Options Trading Definition Forex options trading allows currency traders to realize gains or hedge positions of trading without having to purchase the underlying currency pair, forex options trading tutorial.

What Is Forex FX and How Does It Work? Forex FX is the market for trading international currencies. The name is a portmanteau of the words foreign and exchange.

Pip Definition A pip is the smallest price increment fraction tabulated by currency markets to establish the price of a currency pair. Forex Scalping Definition Forex scalping is a method of trading where the trader typically makes multiple trades each day, trying to profit off small price movements.

Forex Forex options trading tutorial Strategy Definition A forex trading strategy is a set of analyses that a forex day trader uses to determine whether to buy or sell a currency pair.

Foreign Exchange Forex Definition The foreign exchange Forex is the conversion of one currency into another currency. About Us Terms of Use Dictionary Editorial Policy Advertise News Privacy Policy Contact Us Careers California Privacy Notice. Forex options trading tutorial is part of the Dotdash publishing family, forex options trading tutorial.

Interactive Brokers Tutorial- Options trading with IB

, time: 14:31How To Trade Currency Using Forex Options

![How to Trade Forex for Beginners in [3 Simple Strategies] - Admirals forex options trading tutorial](https://i.ytimg.com/vi/E7nx5U20uOU/maxresdefault.jpg)

The trader sets the price and the date. Requires less money up-front compared to the spot Forex position. The option can hedge against cash positions and limit risks. Options give the opportunity to trade on predictions about future market movements without the risk of losing a lot of capital 9/28/ · Let’s continue this Forex trading basics tutorial with the major currencies that are traded on the Forex market. Those include the US dollar (USD), euro (EUR), British pound (GBP), Swiss franc (CHF), Japanese yen (JPY), Australian dollar (AUD), New Estimated Reading Time: 8 mins This tutorial covers the fundamentals of forex trading. Audience. This tutorial is prepared for beginners to gain some knowledge before they begin their journey with trading. Professional who are already into forex trading can also draw benefit from this tutorial. Prerequisites. We assume that you know the essential terms related to forex trading and the basic standards of currency trade

No comments:

Post a Comment