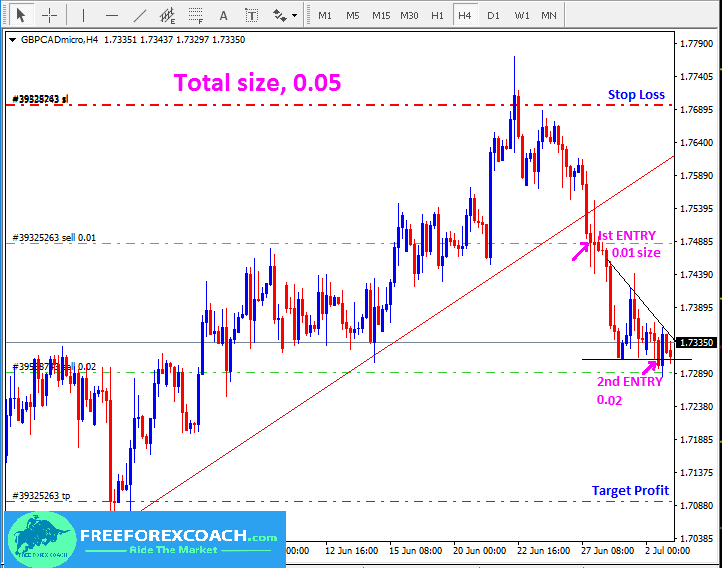

Commander in Pips: The major principle to any scaling framework is to improve probability/risk parameters – either remain risk the same and increase probability to success or remain probability the same and reduce risk. The same should be done with scaling into a winning position The Scale-In page gives you two options: Set up each leg manually with your lot size, entry price and stop; or use the one-click auto-configure button to plan out entry levels at regular intervals (ex., every 10 pips). See at a glance what your risk to reward will be for the complete aggregate set of trades What Is Scaling In? Scaling in is the act of buying into a position gradually over time. Once you have set the amount that you are willing to risk, whether it’s a set amount or 5% of your Forex account, you can divide that up by the number of orders you expect to span your purchases of the asset across. If you see a trend developing that you

Learn Forex: How to Scale In to Positions

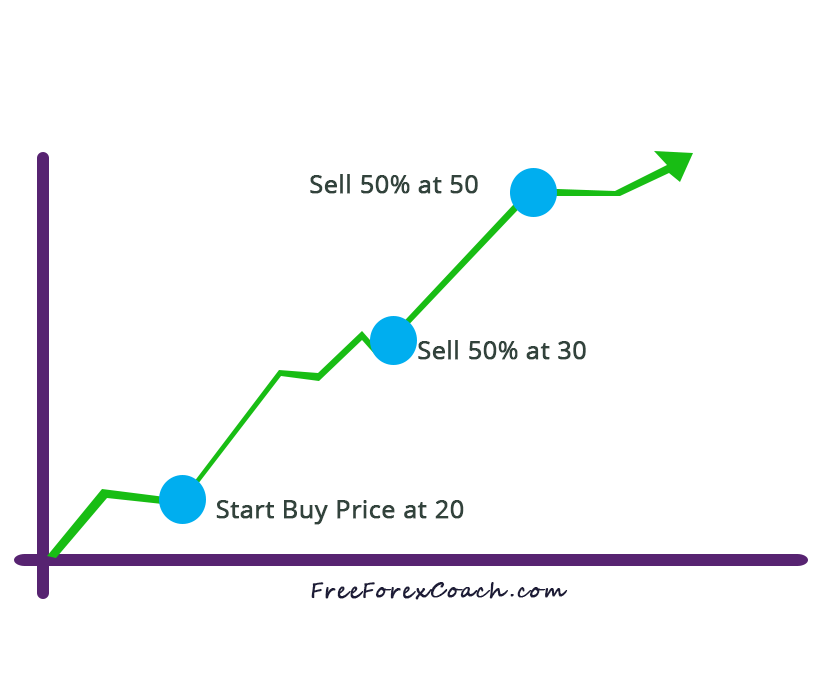

You can actively manage your overall risk by scaling in and out of positions. Simply said, scaling in forex, scaling means adding or removing units from the position size of your trade. This means, you add to your positions scaling in forex the trade is profitable, and close some of your positions when the trade goes against you. Scaling can help you to lock in your profits and reduce your overall risk on a particular trade.

It also helps to catch the best entry point for a trade, as you can add to your position around an important price level without having to exactly know where the right entry point is. However, scaling also comes with its drawbacks. While it can be used to reduce overall risk, scaling into a position can also increase your risk if you improperly add more and more units to an existing position. Scaling out of positions always reduces your risk as you reduce the market exposure, but also limits the potential profits you can make.

As the price moves higher and your trade becomes profitable, you find out that the Fed might hike interest rates which is bullish for the Scaling in forex dollar. A smart move would also be to put a trailing stop on the remaining position, in case the price scaling in forex against you.

However, if the total risk of the positions is inside your risk per trade, you can do so, but always remember to use stop-loss orders. As this is a support zone, and not line, there is no precise price level where you could jump into the trade, scaling in forex.

Instead, you can scale into the trade by opening 5k units at one price, and once the trade shows to payoff, another 5k at a higher price. By Admin. Skip to content Subscribe to Our Newsletter. Get FREE Forex Tips Delivered To Your Inbox Expert Analysis Education Forex Tools.

Scaling In and Out of Positions, scaling in forex. Weekly Trading Tips Straight To Your Inbox. Subscribe Today! Article Name. How to Minimize Risk by Scaling In and Out of Positions. When Scaling in and out of positions, scaling in forex, you always need to follow these rules: 1.

The levels for adding or removing additional units should always be predetermined 2. Your total risk should never exceed your total acceptable risk-per-trade, scaling in forex, as stated by your trading plan and risk management 3. Use trailing stops to limit the risks of scaling. Publisher Name.

September 07, By Admin Scaling in forex Breakouts A breakout happens when the price breaks a support and resistance level, September 07, By Admin Determining Market Environment Not every trading strategy is suitable for every market environment. September 07, By Admin Trading Divergences Divergences are a great way to determine tops and bottoms of trends, and thus Education Home Beginner: Start Here to Learn to Trade Advanced: Learn and Develop Trading Strategies Expert: Learn and Execute Expert Level Strategies.

How to \

, time: 8:32Scaling In To Optimize Forex Profits - FX Trading Revolution | Your Free Independent Forex Source

4/14/ · Short 2, units of EUR/USD at According to our pip value calculator, 2, units of EUR/USD means your value per pip movement is $ With your stop at , you have a pip stop on this position, and if it hits your stop that is a $50 loss (value per Estimated Reading Time: 4 mins Commander in Pips: The major principle to any scaling framework is to improve probability/risk parameters – either remain risk the same and increase probability to success or remain probability the same and reduce risk. The same should be done with scaling into a winning position The Scale-In page gives you two options: Set up each leg manually with your lot size, entry price and stop; or use the one-click auto-configure button to plan out entry levels at regular intervals (ex., every 10 pips). See at a glance what your risk to reward will be for the complete aggregate set of trades

No comments:

Post a Comment