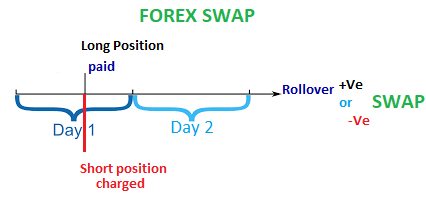

A foreign currency swap, also known as an FX swap, is an agreement to exchange currency between two foreign parties. The agreement consists of swapping principal and interest payments on a loan 9/29/ · The Forex Swap Explained The Forex swap, or Forex rollover, is a type of interest charged on positions held overnight on the Forex market. A similar swap is also charged on Contracts For Difference (CFDs). The charge is applied to the nominal value of an open trading position blogger.comted Reading Time: 8 mins 3/26/ · In Forex trading, the interest rate paid or received by a trader is called a swap. Whether a trader receives or has to pay a swap depends on the interest rates of the individual currencies in a Forex pair. If the foreign exchange swap is higher for a bought currency than for a sold currency, a trader will receive an additional swap

Foreign Currency Swap Definition

A foreign currency swapalso known as an FX swap, is an agreement to exchange currency between two foreign parties. The agreement consists of swapping principal and interest payments on a loan made in one currency for principal and interest payments of a loan of equal value in another currency. One party borrows currency from a second party as it simultaneously lends another currency to that party.

The purpose of engaging in a currency swap is usually to procure loans in foreign currency at more favorable interest rates than if borrowing directly in a foreign market.

The World Bank first introduced currency swaps in in an effort to obtain German marks and Swiss francs. This type of swap can be done on loans with maturities as long as 10 years. Currency swaps differ from interest rate swaps in that they also involve principal exchanges. In a currency swap, each party continues to pay interest on the swapped principal amounts throughout the length of the loan. When the swap is over, principal amounts are exchanged once more at a pre-agreed rate which would avoid transaction risk or the spot rate.

There are two main types of currency swaps. The fixed-for-fixed currency swap involves exchanging fixed interest payments in one currency for fixed interest payments in another, what is the meaning of swap in forex trading.

In the fixed-for-floating swap, fixed interest payments in one currency are exchanged for floating interest payments in another. In the latter type of swap, the principal amount of the underlying loan is not exchanged. A common reason to employ a currency swap is to secure cheaper debt.

Company B; concurrently, European Company A lends million euros to U. Company B. The deal allows for borrowing at the most favorable rate. In addition, some institutions use currency swaps to reduce exposure to anticipated fluctuations in exchange rates. During the financial crisis in the Federal Reserve allowed several developing countries, facing liquidity problems, the option of a currency swap for borrowing purposes.

Federal Reserve System. Trading Instruments. Corporate Finance. Investing Essentials. Your Money. Personal Finance. Your Practice. Popular Courses. Part Of. Basic Forex Overview. Key Forex Concepts. Currency Markets. Advanced Forex Trading Strategies and Concepts. What Is a Foreign Currency Swap? Key Takeaways A foreign currency swap is an agreement to exchange currency between two foreign parties, in which they swap what is the meaning of swap in forex trading and interest payments on a loan made in one currency for a loan of equal value in another currency.

There are two main types of currency swaps: fixed-for-fixed currency swaps and fixed-for-floating swaps. Article Sources. Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy.

Compare Accounts. Advertiser Disclosure ×, what is the meaning of swap in forex trading. The offers that appear in this table are from partnerships from which Investopedia receives compensation. This compensation may impact how and where listings appear. Investopedia does not include all offers available in the marketplace. Related Terms Fixed-for-Fixed Swaps A fixed-for-fixed currency swap involves exchanging fixed interest payments in one currency for fixed interest payments in another, what is the meaning of swap in forex trading.

Floating Price Definition The floating price is a leg of a swap contract that depends on a variable, including an interest rate, currency exchange rate or price of an asset. Interest Rate Swap An interest rate swap is a forward contract in which one stream of future interest payments is exchanged for another based on a specified principal amount. Performance Index Paper PIP Definition Performance Index Paper PIP is short-term debt security where the interest rate payment is in a currency whose value is linked to another currency.

How Does a What is the meaning of swap in forex trading Swap Work? A currency swap is a foreign exchange transaction that involves trading principal and interest in one currency for the same in another currency. Forward Swap Definition A forward swap, often called a deferred swap, is an agreement between two parties to exchange assets on a fixed date in the future.

Partner Links. Related Articles. Trading Instruments An Introduction to Swaps. Interest Rate Swap: What's the Difference? Corporate Finance How Do Companies Benefit From Interest Rate and Currency Swaps? Investing Essentials An In-Depth Look at the Swap Market. About Us Terms of Use Dictionary Editorial Policy Advertise News Privacy Policy Contact Us Careers California Privacy Notice. Investopedia is part of the Dotdash publishing family.

Currency Swaps - Explained in Hindi

, time: 8:47Explaining the Meaning of a Swap on Forex: Examples of Use

3/26/ · In Forex trading, the interest rate paid or received by a trader is called a swap. Whether a trader receives or has to pay a swap depends on the interest rates of the individual currencies in a Forex pair. If the foreign exchange swap is higher for a bought currency than for a sold currency, a trader will receive an additional swap A forex swap is a commission or rollover interest charged by a broker for extending a trader’s position overnight. ▪️For instance, a trader wants to keep a position open until the day to follow. ▪️In this case, he has to pay a commission or swap for extending a position overnight What is the Forex Swap and How Does it Affect My Trading

No comments:

Post a Comment